The protests in China push stock markets lower this morning. Interestingly, the Dollar is also under pressure. And that's the problem with all the Dollar longs out there. It is always possible that correlations change and the automatism risk off = Dollar strength is over. However, it is still too early to declare the end of the Dollar. It's only Monday morning and the market may need to sort itself out after the Americans' Thanksgiving celebrations.

At time of writing the Dollar-Index (DXY) is trading above the 105 treshold. But still the index looks battered. Brave guys try to fade the morning dip above the minor support around 105.30, but below 105 I would be wary with longs. However, the August lows around 104.63/64 must hold.

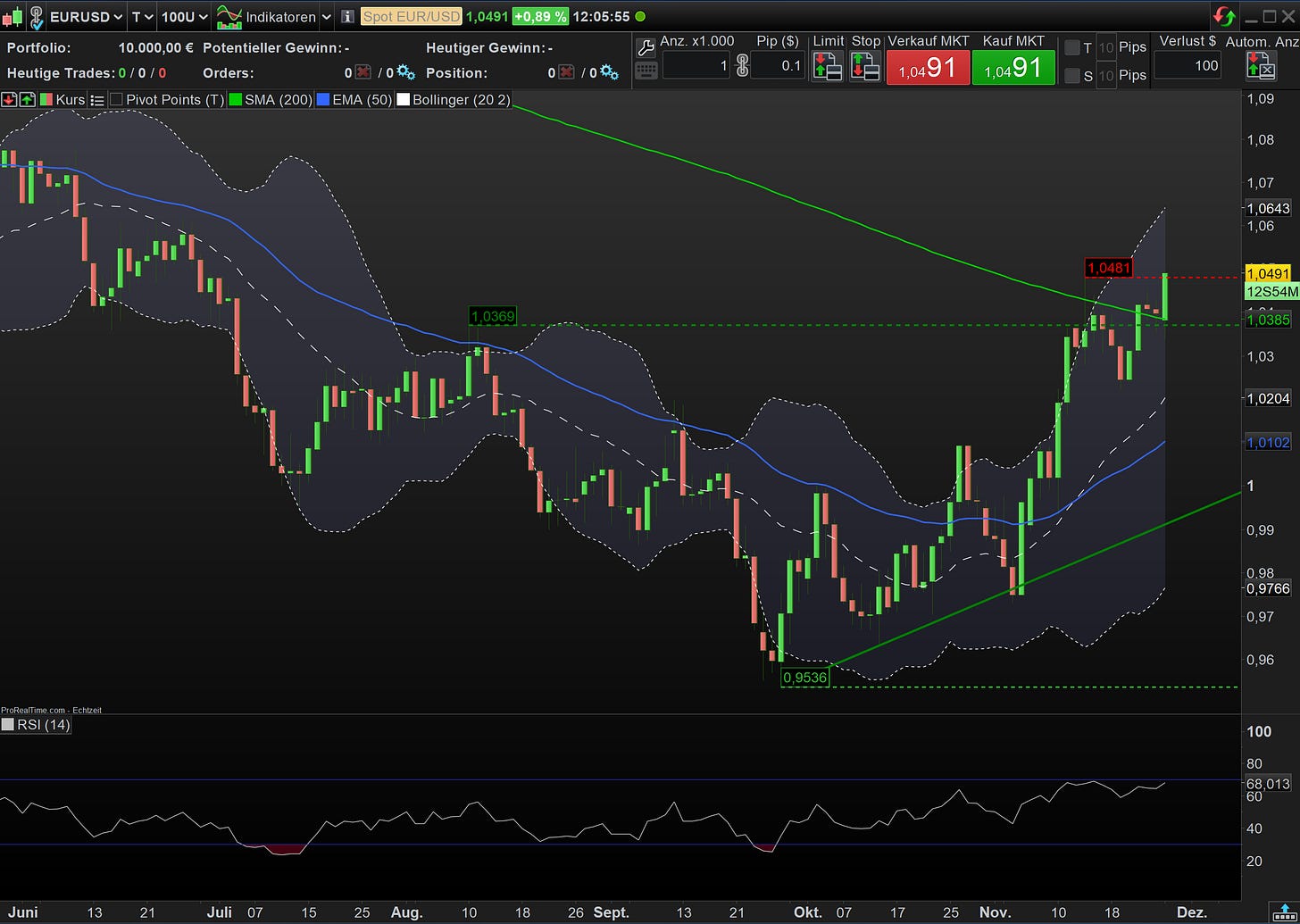

EURUSD -- 1.0491

The currency pair had an early dip during today’s Asian session to a low of 1.0340 clearly below the 200 dma (1.0385) but reversed quickly. Since then, the Euro has been running and is currently testing resistance at 1.0481 (hod 15nov). Above the bigger 1.0500/25 level I would not fade the rally anymore.

GBPUSD -- 1.2087

The 200 dma (1.2178) is still looming and a real test is probably imminent. Should the curreny pair quickly overshoot the average line to 1.2284 (upper Bollinger band) and 1.2294 (August highs) one might think about fading the Sterling rally. But where do you stop then?

USDJPY -- 137.84

Small support comes in at 137.67 (lod 15nov). If current spot does not hold, the lower Bollinger band (135.13) and the 200 dma (134.08) moves into the focus of the protagonists. But the gap is still comparatively large and another trigger may be needed. The 140 is now the big level to the upside.

Good luck,

Sebbo