Yesterday the dollar rally came to an end for the time being. The dollar index (DXY) turned red after touching the 104 treshold (hod 103.964). Overall, however, it was a quick 3% rally in three days, which of course leads to profit-taking. With regard to individual currency pairs, important levels were also reached.

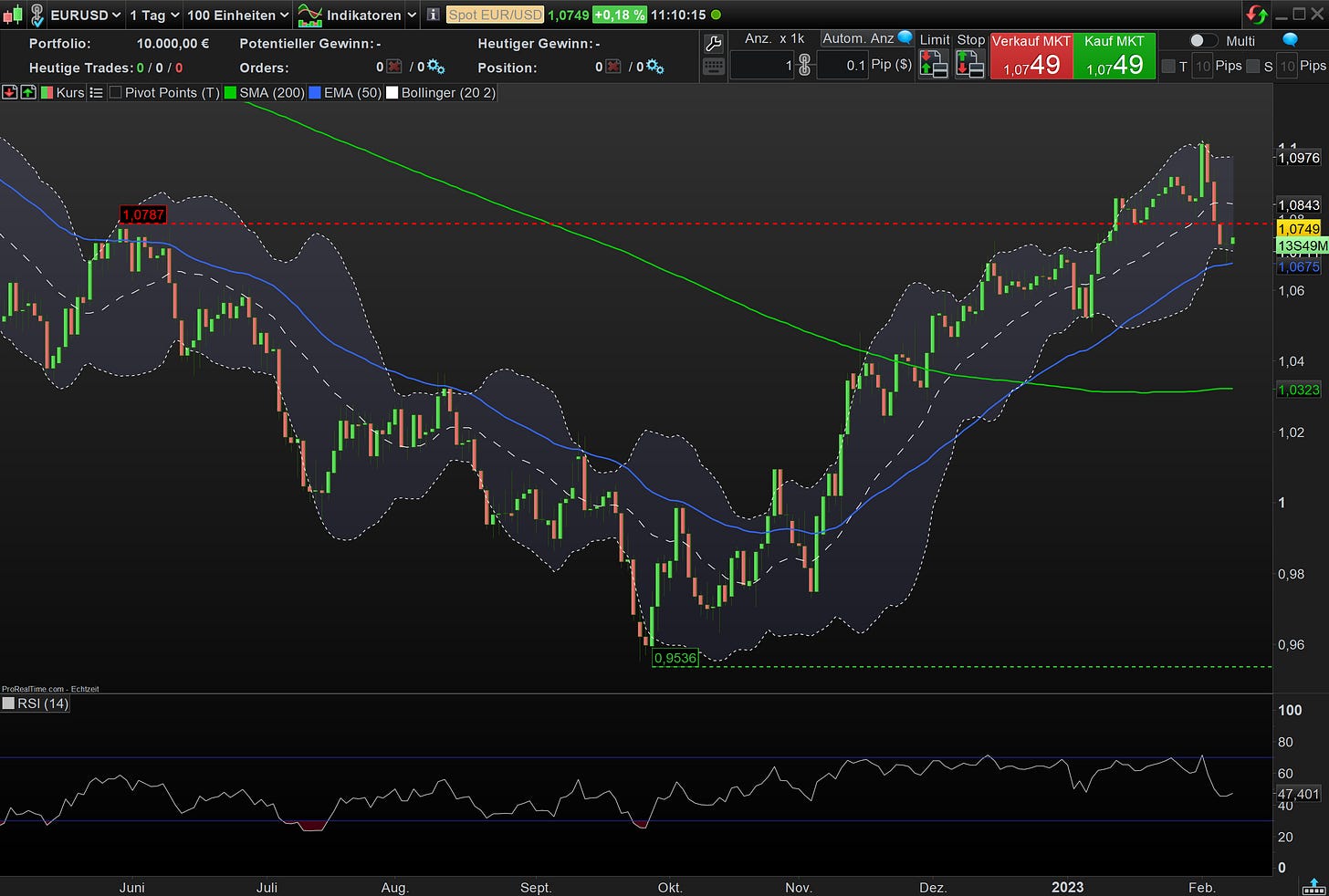

EURUSD -- 1.0749

The 50 ema (1.0675) worked well as support and could initially limit the downward movement in the short term. Next resistance comes in at the 1.0787/00 mark. Above the mid Bollinger band (1.0844) a retest of the big 1.1000/1.1200 resistance zone gets more likely.

GBPUSD -- 1.2088

1.2400 has proven to be the right level to play the pound from the short side. With yesterday's test of the 200-daily line (1.1949), the short scenario is over for me for the time being. Around 1.2000 there will be great interest in buying in the short and medium term, which could prevent lower spot rates for the next sessions.

AUDUSD -- 0.6978

The Aussie also found a bottom the last two trading days. Above the lower Bollinger band (0.6865) and the 50 ema (0.6884) the currency pair is well supported and some pips below the 0.6829 pivot line and the 200 dma (0.6807) are building the next support zone. Above the mid Bollinger band (0.7010), the rally could gain momentum.

Good luck,

Sebbo